Whether you are a small business or running a large company, you should have a reliable payment gateway solution for scaling your e-commerce business, With online shopping becoming famous, the need for safe and robust payment systems is also increasing.

E-commerce is the fastest-growing market in the UAE. Businesses in the UAE always search for the best tools to ensure efficient and secure payment for online transactions. One such tool that is important for this purpose is the payment gateway UAE. Enter into the exciting world of buying and selling online in the UAE!

They act like a secret agent who makes sure that everything runs smoothly in the world of online shopping. Imagine, you are doing online shopping, choosing to buy something you love. That’s where online payment gateway UAE comes in, they make sure that your purchase happens without any hitch, helping to make online shops work well and successfully.

This blog will explore the key factors to consider when choosing the best payment gateway in UAE, including an overview of some of the top contenders, and provide insights to help small businesses make informed decisions.

Understanding Online Payment Gateways

Before diving into the specifics of choosing the best payment gateway UAE, it’s essential to understand what an online payment gateway is. In simple terms, a payment gateway is a technology that connects your online store with the financial networks involved in the transaction process. It securely authorizes credit card or direct payment processing for e-businesses, online retailers, and brick-and-clicks businesses.

The Importance of Payment Gateways

Online payment gateways serve as the backbone of any e-commerce platform. They enable transactions to be processed smoothly, ensuring that both the buyer and seller have a seamless experience. For businesses in Dubai and across the UAE, having a reliable payment gateway is not just a luxury but a necessity. A successful payment gateway ensures that transactions are secure, fast, and efficient, directly impacting customer satisfaction and, ultimately, business success.

Key Factors for Choosing the Best Online Payment Gateway in UAE

Selecting the right online payment gateway UAE can be daunting, given the multitude of options available. Here are some key considerations to keep in mind:

1. Security Features

Security should be the main thing on the list when choosing a payment gateway Dubai. Customers put their trust in businesses with sensitive information such as credit card details, and any breach can lead to great financial and reputational loss. Look for gateway solutions in Dubai that are PCI DSS compliant and offer robust encryption methods for data protection.

2. Ease of Integration

The best online payment gateway in UAE should seamlessly integrate with your existing website and e-commerce platform. Consider how the payment gateway can be integrated with your current system and whether it supports popular shopping carts and platforms. A smooth integration process reduces the time and resources needed to get your payment system up and running.

3. Transaction Fees

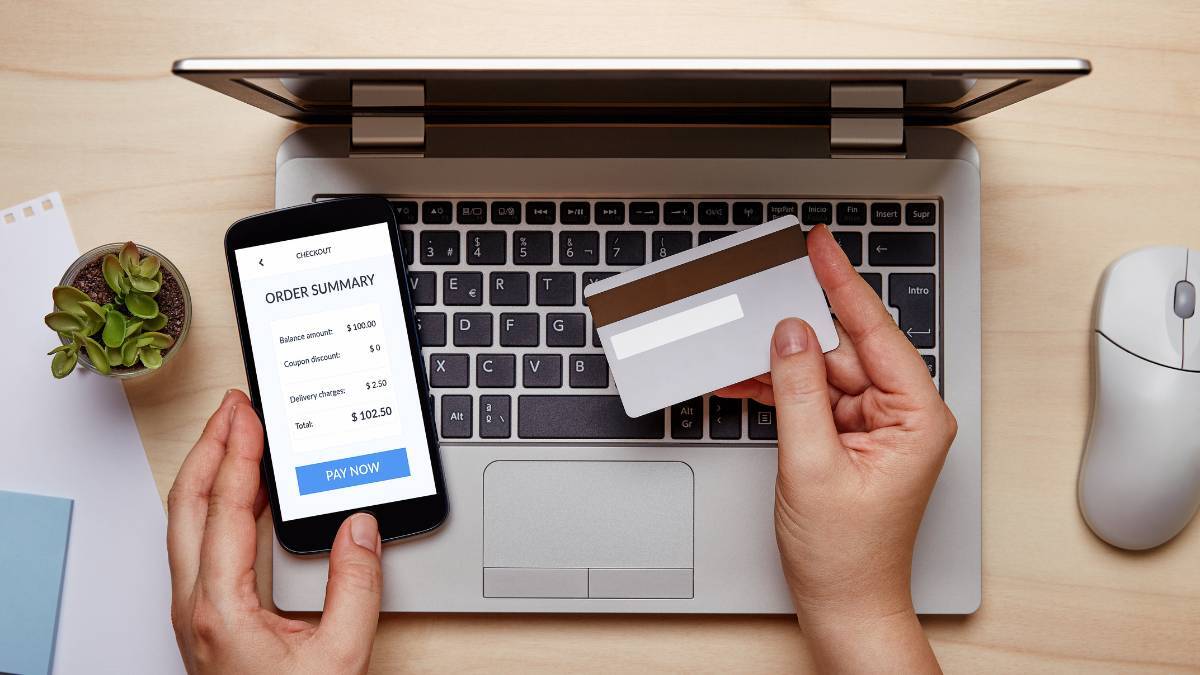

Transaction fees can greatly impact a small business’s bottom line. Compare the costs associated with different payment gateways, including setup fees, monthly fees, and per-transactions charges. While some gateways may offer lower fees, consider the trade-offs in terms of features and customer support.

4. Payment Methods Supported

In the UAE, consumers prefer various payment methods, including credit and debit cards, mobile wallets, and bank transfers. Ensure that your chosen payment gateway in UAE supports a variety of payment methods to cater to the needs of customers.

5. Customer Support

Responsive customer support is important, especially when dealing with payment-related issues. Choose the best payment gateway Dubai provider that gives reliable customer support through various channels, such as phone, live chat, or email, to respond to an issue quickly.

6. Reputation and Reliability

Research the reputation and reliability of the payment gateway in Dubai you want to choose. Search for reviews and testimonials from other businesses in Dubai and the UAE to see their experience. A good and successful payment gateway will have a proven track record of excellent performance and minimal downtime.

7. Scalability

As your business grows, your payment gateway should be able to scale with it. Choose a payment gateway that can accommodate increased transaction volumes and expand its features as your business needs evolve.

Top Online Payment Gateway UAE

Now that we’ve covered the key considerations, let’s explore some of the best payment gateway options available in the UAE.

1. Payoneer

Payoneer was founded in 2005 and has come out as the best online payment gateway UAE, fulfilling the diverse needs of business. Payoneer is best known for its global reach, Payoneer in UAE is offering secure and seamless cross-border transactions. Some of the main features that made Payoneer the best choice for businesses in Dubai include multi-currency support, fund transfers, and dispute resolutions.

2. Telr

It was formerly known as Innovative Payments, Telr is one of the good and award-winning payment gateways in the UAE. It was created in 2014 and offers payment solutions in more than 120 currencies and supports approximately 30 languages. It has an easy-to-open account method with no setup fees. Telr is an easy payment gateway UAE provider to users. Many e-commerce companies use Telr with options like digital invoicing, social commerce, QR codes, Telr BNPL, etc.

3. PayTabs

PayTabs is a good choice among businesses in the UAE, offering several features that cater to small businesses and large companies. With a focus on security and ease of integration, PayTabs offers a seamless experience for merchants and customers. It supports multiple currencies and payment methods, making it an ideal choice for businesses targeting international markets

4. Checkout

This payment gateway is popular for its seamless and smooth user experience. Checkout is surely a worthy mention in the list of best online payment gateways UAE. It offers customized solutions to various users for their distinct needs. Checkout allows more than 45 methods of payment with support for over 110 e-commerce integrations. It has a simple setup procedure for users, verified payment integration methods, and ease of transactions.

5. Network International

Network International is one of the leading payment gateway providers in the Middle East, offering a wide range of payment solutions for businesses in the UAE. With a strong focus on security and innovation, Network International provides a reliable platform for processing transactions. It supports various payment methods and offers tailored solutions for different industries.

6. Stripe

Stripe is one of the best payment gateways in the UAE. It provides businesses with a complete suite of APIs for online payment processing, managing subscriptions, along various other commerce solutions. Stripe allows businesses to accept payments through MasterCard, American Express, Visa, etc. This payment gateway also supports multiple currencies and in-person payment in the shape of a point of sale, Stripe Terminal.

7. CashU

Began with the exclusive goal of serving the Dubai, United Arab Emirates, audience. The most popular and favored payment gateway in the UAE right now is CashU. Because it incorporates AML procedures for fraud prevention, this is the most robust and secure payment gateway option available.

Customers may finish all of their transactions with CashU without worrying about facing a chargeback. There isn’t a setup charge or security deposit needed. Nonetheless, there is an annual cost that is entirely based on the company’s sales volume.

8. CyberSource

Because Cybersource gives consumers access to online payment choices worldwide, we can rank it as one of the finest payment gateways in the UAE. It is a division of the well-known global company VISA and offers users a variety of payment options.

At the moment, Cybersource has operations in over 190 nations. This payment gateway for the UAE accepts both local wallets like Alipay and digital payments like Apple Pay and Android Pay. Regarding the audience in the United Arab Emirates, in particular, Apple Pay is extensively utilized there due to its seamless integration with Apple products.

Conclusion

Choosing the best online payment gateway in the UAE is an important decision that can greatly impact your business success. By considering factors like security, integration ease, transaction fees, and customer support, you can make an informed decision that fulfills your business goals.

With options like Telr, Checkout, Payoneer, Network International, etc. businesses in Dubai and the UAE have access to exceptional and efficient payment gateway options.

By implementing the right payment gateway, you can enhance the customer experience, drive sales, and position your business for long-term success in the competitive e-commerce landscape.

For businesses looking to enhance their digital presence and integrate a successful online payment gateway, exploring website development Dubai services is a step in the right direction.

Companies like Turn Up Technologies offer comprehensive solutions tailored to the unique needs of businesses in the UAE, ensuring seamless payment processing and improved customer satisfaction.